ÚLTIMAS NOTICIAS

NOTICIA PATROCINADA

RENOVABLES

Lo que necesito saber sobre…

- Tarifa regulada PVPC y Tarifa de mercado libre

- Qué potencia contrato, periodos de discriminación horaria

- Cómo mejorar la eficiencia energética en casa o en la empresa

- Consejos útiles para ahorrar

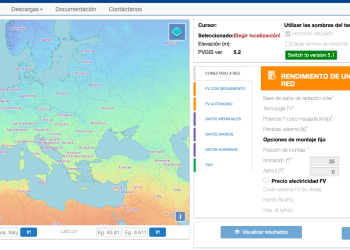

- Qué hacer para poner una instalación de autoconsumo fotovoltáico en casa

- Qué hacer para poner una instalación de autoconsumo eólico en casa

MÁS NOTICIAS

IRENA y ACWA Power firman un acuerdo para impulsar la transición a energías limpias

ACWA Power, la empresa privada de desalinización de agua más grande del mundo, es uno de los líderes en transición...

La Comisión hace balance de los Diálogos sobre la Transición Limpia con la industria y los interlocutores sociales de la UE

La Comisión Europea ha lanzado una comunicación con el balance tras los Diálogos sobre la Transición Limpia. La jornada, celebrada...

Endesa reafirma su compromiso de alcanzar las cero emisiones en 2040

El consejo de administración de Endesa ha aprobado el Plan Estratégico de Sostenibilidad 2024-2026, elaborado con la participación de todas las...

Carta a los mercados mayoristas de la Agencia de Cooperación de los Reguladores de la Energía (ACER) sobre la revisión del Reglamento REMIT

La CNMC ha informado a los agentes de los mercados mayoristas de la energía de la publicación de una carta...

FCH2RAIL prueba con éxito su tren de hidrógeno en Portugal

FCH2RAIL, el consorcio que experimenta con un tren de hidrógeno, ha completado de forma exitosa unas pruebas en Portugal. El...

Avance de mercado de Grupo ASE: “La electricidad ha estado a 0 euros la mitad de las horas de abril y seguirá hundida a final de mes”

El avance del Grupo ASE indica que: la electricidad ha estado a 0 euros la mitad de las horas de...

50 M€ de fondos europeos para que Iberdrola l bp pulse despliegue de infraestructura de recarga de alta potencia

Iberdrola l bp pulse ha resultado adjudicataria de 50 M€ de fondos europeos para acelerar el despliegue de infraestructura de...

Soltec suministra 367 MW de su seguidor SFOne a un proyecto de X-ELIO en Murcia

Soltec ha anunciado que suministrará 367 MW de su seguidor SFOne para un proyecto de la compañía X-ELIO. La planta...

«La eólica marina da lugar a factores de capacidad más elevados y sus aerogeneradores son de mayor envergadura”

La eólica marina es una tecnología que está dando sus primeros pasos. Las opiniones, según vemos en ocasiones, son contradictorias....

Cepsa acuerda con Evos el almacenamiento de su producción de metanol verde

Cepsa y Evos han formalizado un acuerdo por el que la energética almacenará el metanol verde que produzca en las...